By political correspondent Emma Griffiths

Video: Commission of Audit proves need for tough action, says Hockey (ABC News)

Photo: Joe Hockey says not all of the commission's recommendations will be popular. (AAP: Lukas Coch)

A raft of potentially explosive spending cuts to government services and payments have been recommended by the Federal Government's Commission of Audit.

Family payments, child care, health care, education, unemployment and pension payments, aged care and the National Disability Insurance Scheme are all among those areas in the firing line.

The audit also recommends swingeing cuts to industry assistance and the public service and a radical shake-up of the way all governments tax and do business.

Treasurer Joe Hockey has been quick to emphasise that the report is "not the budget" but has not ruled out adopting any of the proposals.

Since it was set up in October, the commission has focused on the 15 biggest Commonwealth spending areas and found the long-term outlook for the budget is "ominous".

Its 86 recommendations, detailed in more than 1,200 pages, address major structural changes that the commission says could save the budget tens of billions of dollars a year and achieve a surplus of 1 per cent by 2023-24.

Commission chief and former head of the Business Council of Australia Tony Shepherd says the best course of action for the Government is to "act now, act incrementally, act fairly".

He has advised against "sudden shocks" for people, but says the Government "must bring future spending commitments in line with our means".

"Let's spend the taxpayers' money as though it were our money," Mr Shepherd said.

"Let's spend it carefully and frugally."

Embed: Chart showing projected cost of large programs over next decade

The commission says in its report that it has "not undertaken detailed costings of these recommendations" and says portfolio-by-portfolio reviews should yield "significant additional savings".

The Treasurer says the report proves the Coalition "inherited a mess".

"The challenge now is to get on with the job of fixing the mess, and we will," he said.

Some key recommendations

- Raise age pension age to 70 by 2053

- Include family home in new means test from 2027

- Slow roll-out of National Disability Insurance Scheme

- Allow states to impose personal income tax surcharge, offset by reduction in federal rates

- Scrap Family Tax Benefit Part B and a new means test for Part A with maximum rate of payment reducing from at $48,837

- Lower paid parental leave scheme salary cap to average week earnings (currently $57,460) and use savings for expanded child care payments

- Privatise Australia Post, NBN Co, Defence Housing, Snowy Hydro among other government-owned enterprises

Read a more extensive list of recommendations here

He said the report is "to the Government, not of the Government", but would not lay out which recommendations the Coalition would adopt or reject.

"I want to lay down to you - this is not the budget," he said. "And we have carefully and methodically gone through the recommendations.

"There are a number of recommendations that would be described as courageous, to use a term familiar with some in Canberra.

"There are some recommendations that represent common sense. When you see our budget you'll understand that we are focused on responding to the challenge in a measured and methodical way."

Labor has leapt on the report as proof the Government plans to hit working families in this month's budget.

"It is a plan to cut the services that families rely on and to put greater pressure on cost of living," Opposition Leader Bill Shorten said.

"If he gets his way, Tony Abbott will turn the most basic things in life - education, health care, support for older Australians - into a massive every-day struggle for working families."

Families

Commission's case for change

The Commission of Audit's recommendations fall roughly into three categories: the brave, the crazy brave and the politically suicidal, writes Chris Uhlmann

People with children would be hit with cuts to Family Tax Benefit payments, with FTB Part B abolished, and Part A subject to tighter eligibility tests.

Around 60 per cent of families, mostly single parent families or those with one parent staying at home, receive FTB Part B, which pays a maximum of $4,241 a year.

But the commission says it is "not well targeted" and is a "significant" disincentive for mothers to work.

The other payment, FTB Part A, costs the budget around $15 billion a year and is paid to around 70 per cent of families.

The commission says the income cut-off should be lowered to better help "those in need".

Childcare and parental leave

Childcare payments, currently the Childcare Benefit and Childcare Rebate, are proposed to be merged and means-tested.

However, the commission recommends the payment be available for types of child care not currently covered, including nannies.

That would be funded by savings made to the Prime Minister's signature wage-replacement paid parental leave scheme. The commission wants to lower the threshold and cap it at average weekly earnings – currently $57,460.

Yesterday, in a major backdown, Tony Abbott confirmed he had already decided to lower the cap from his preferred $150,000 annual wage to $100,000.

Health

Industry assistance in the crosshairs

Industry assistance and support for exporters and the tourism sector face the axe under proposals from the Commission of Audit.

The health system is currently "not well equipped" to deal with Australia's ageing population and rising costs, according to the commission.

It says high income earners should be forced to take out private health insurance to cover basic health needs, in place of Medicare, with no access to the private health insurance rebate.

The widely reported Medicare co-payment is also on the commission's wish-list, but at a higher rate than has been mooted: $15 per visit and $5 for concession card holders, instead of the $6 fee for high-income earners.

It wants cuts to the $19 billion Medicare Benefits Schedule, which includes hundreds of medical services, for example pathology.

Free medicines would also be a thing of the past, with broad changes recommended to the Pharmaceutical Benefits Scheme.

The commission says co-payments for medicines should be increased by $5 and for concession card holders a $2 fee should be imposed when the safety net limit has been reached.

Learn or earn

Schools spending from the Commonwealth should be capped at 2017 levels from 2018 and beyond, according to the commission, with all policy and funding responsibility handed to the states.

It wants university students to pay more for their education, calling for "increasing the average proportion of costs paid by students from 41 per cent to 55 per cent".

People between the ages of 22 and 30 with no children who have been on unemployment benefits for a year should be required to move to areas with more job opportunities or lose the payment, the commission argues.

Growth in the minimum wage should be contained by establishing a benchmark of 44 per cent of average weekly earnings, even though the minimum wage has little bearing on government spending.

Retirement

Photo: Commission of Audit chairman Tony Shepherd at Parliament House today (AAP: Lukas Coch)

Changes to pensions are central to the commission's proposals. It calls for the age pension – the budget's single biggest item at $40 billion – to be indexed to 28 per cent of average weekly earnings instead of the current link to the higher average weekly earnings of men.

The commission says the rationale is an "anachronism" given the major role women now play in the workforce. As previously reported, it wants the age pension eligibility age raised to 70, by 2053, and says the change would not affect anyone born before 1965.

The age at which someone could access their superannuation - currently set at 60 - should also be increased to five years before the age pension age, according to the commission.

It wants fewer people able to access the seniors health care card by including superannuation payments in the eligibility test for the first time.

The commission also argues the full value of the family home should be included in the means test for aged care support.

The disability support pension and carers payments would also be subject to tighter eligibility rules.

Acknowledging the "significant risks involved", the commission has also recommended the Government examine the option of outsourcing the government payment system currently administered by Centrelink.

NDIS

The National Disability Insurance Scheme (NDIS), which passed Parliament with bipartisan support and to wide acclaim a year ago, is also set to be wound back.

The commission says it must be introduced more slowly than the July 1, 2019 date set by the previous Labor government.

It also wants the scheme implemented by "exercising budget control to ensure long-term financial viability".

Public service targeted

A key theme running throughout the report is the need for cuts to the public service to avoid duplication and to allow the private sector to step in.

The commission says if all of its recommendations are adopted, 15,000 public servants will lose their jobs.

It wants wholesale changes to the number and role of government bodies, reducing the number of existing major government bodies from 73 by cutting seven, merging 35, consolidating 22 into departments and agencies and privatising nine, with a further 26 to be reassessed.

Taxes

One of the more startling recommendations from the commission is that the Commonwealth allow the states and territories to collect income tax to "make them more responsible in their own sphere".

It gives the example that the current rate of 32 per cent could be cut to 22 per cent, allowing the states to raise the gap or set their own level in a "state income tax surcharge".

If adopted, it would allow a United States-type scheme of tax competition between states with a guarantee that taxes would not rise overall.

The audit's key recommendations

- Raise age pension age to 70 by 2053

- Include family home in new means test from 2027

- Raise superannuation preservation age to 62 by 2027

- Slow roll-out of National Disability Insurance Scheme

- Up to $15 co-payment to visit doctor and access Medicare services

- Require wealthy Australians to have private health insurance and drop rebate

- Increase co-payments for taxpayer-funded PBS-covered medicines

- Open pharmacy sector to competition, such as from supermarkets

- Allow states to impose personal income tax surcharge, offset by reduction in federal rates

- Scrap Family Tax Benefit Part B and a new means test for Part A with maximum rate of payment reducing from at $48,837

- Lower paid parental leave scheme salary cap to average week earnings (currently $57,460) and use savings for expanded child care payments

- States to be responsible for all schools policy and allocating funding

- Uni students to pay more for degrees and lower HELP repayment threshold to minimum wage

- New benchmark to lower growth in minimum wage so it is equal to 44 per cent of average weekly earnings

- Force young single jobseekers to relocate or lose welfare benefit

- Reduce number of government bodies

- Privatise Australia Post, NBN Co, Defence Housing, Snowy Hydro among other government-owned enterprises

- Abolish the Australia Network

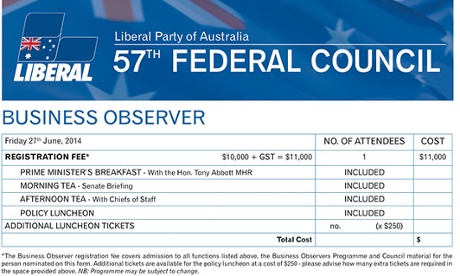

The Liberal party's offer to business observers to have breakfast with the prime minister, Tony Abbott, and afternoon tea with his senior ministers.

The Liberal party's offer to business observers to have breakfast with the prime minister, Tony Abbott, and afternoon tea with his senior ministers. Tony Abbott spent four years in a hi-vis vest telling us over and over about the hit on families from the carbon tax. Photograph: Alan Pottitt/AAP

Tony Abbott spent four years in a hi-vis vest telling us over and over about the hit on families from the carbon tax. Photograph: Alan Pottitt/AAP

The treasurer is worrying about whether the right people are getting welfare. Photograph: Daniel Munoz/AAP Image

The treasurer is worrying about whether the right people are getting welfare. Photograph: Daniel Munoz/AAP Image

Hockey: 'We all have to make contribution because nothing is for free. Nothing can remain for free.' Photograph: Rod Lamkey Jr/AFP/Getty Images

Hockey: 'We all have to make contribution because nothing is for free. Nothing can remain for free.' Photograph: Rod Lamkey Jr/AFP/Getty Images

Prime minister Tony Abbott tries out the cockpit of the F-35 fighter plane in Canberra. Photograph: Alan Porritt/AAP

Prime minister Tony Abbott tries out the cockpit of the F-35 fighter plane in Canberra. Photograph: Alan Porritt/AAP

Treasurer Joe Hockey says the aged pension is in the sights of budget cutters. Photograph: Alan Porritt/AAP

Treasurer Joe Hockey says the aged pension is in the sights of budget cutters. Photograph: Alan Porritt/AAP